Thinking of dropping Principles of Accounts (POA)? Think again.

For Tuition Classes, click here

POA (Principles of Accounts) tuition

Assessment books for N & O Level Principles of Accounts (POA) written by our tutors

Principles of Accounts (POA) has always been a subject misunderstood by many students. As it is a totally new subject introduced only in secondary 3, students tend to close up and refuse to absorb information after getting lost in the first semester.

This is due to a lack of understanding of the subject. Adding on to this is the teaching structure in schools where teachers have to cater to a class of 30-40 students, which means students who cannot keep up will find it very challenging to get back.

Principles of Accounts (POA) is not just about mathematics but it also involves understanding and some memory work. Having taught for several years, I have come up with methods to deliver this knowledge in a basic form which students can understand and absorb very easily. I give many examples that students can relate to in order to better understand a particular topic or concept.

Moreover, I keep my classes small. I make sure that each student can follow what I teach before moving on. This is also important as not all students learn the same way. Isn’t that what tuition classes are for?

I have seen students come in with close to no knowledge of the subject but leave each lesson with more interest and enthusiasm. Not only that, I have seen a bigger jump in grades in this subject more than any other subject. It is not just information that is delivered, it is my belief that all of them can do well.

- Joshua, Specialist on Principles of Accounts, Jaycee Tuition Centre

Roles of Accounts

What is accounting?

It is the process of recording (book-keeping), summarising, analysing, interpreting and reporting of financial information (financial statements).

There are steps to follow when an accountant goes about doing his/her work. They follow the accounting information system:

WHAT IS THE ACCOUNTING EQUATION?

OWNER’S EQUITY = ASSETS – LIABILITIES

KEY CONCEPTS THAT RULE OVER ACCOUNTING:

1. Prudence Concept (Conservatism)

Profits and Assets should not be overstated

Losses and Liabilities should not be understated

2. Going Concern

Business is assumed to operate indefinitely (a very long time)

3. Objectivity

All transactions must be supported by documentary evidence or source documents

4. Historical Cost

All Non-Current Assets are to be recorded at the original cost price (In line with Objectivity concept)

5. Consistency

The same accounting method should be applied for each accounting period for the same business

6. Accounting Entity/ Separate Entity Concept

The business and owner are considered as two separate and different entities

7. Accounting Period

Life of a business is divided into many fixed periods of time for the preparation of financial reports

8. Accrual

All expenses incurred and all income earned in the year have to be recorded regardless whether they have been paid or received

9. Monetary measurement

Only transactions that can be expressed in monetary terms are recorded

10. Materiality

Only items of significant value are to be treated as assets, otherwise, they are considered as expenses

11. Matching principle

All expenses incurred must match against all income earned in the same accounting period to derive an accurate profit for the period

12. Realisation

Income (including sales) should be recorded as earned in the period in which goods or services are provided to customers by the business

13. Duality

Each transaction affects a business in two different ways

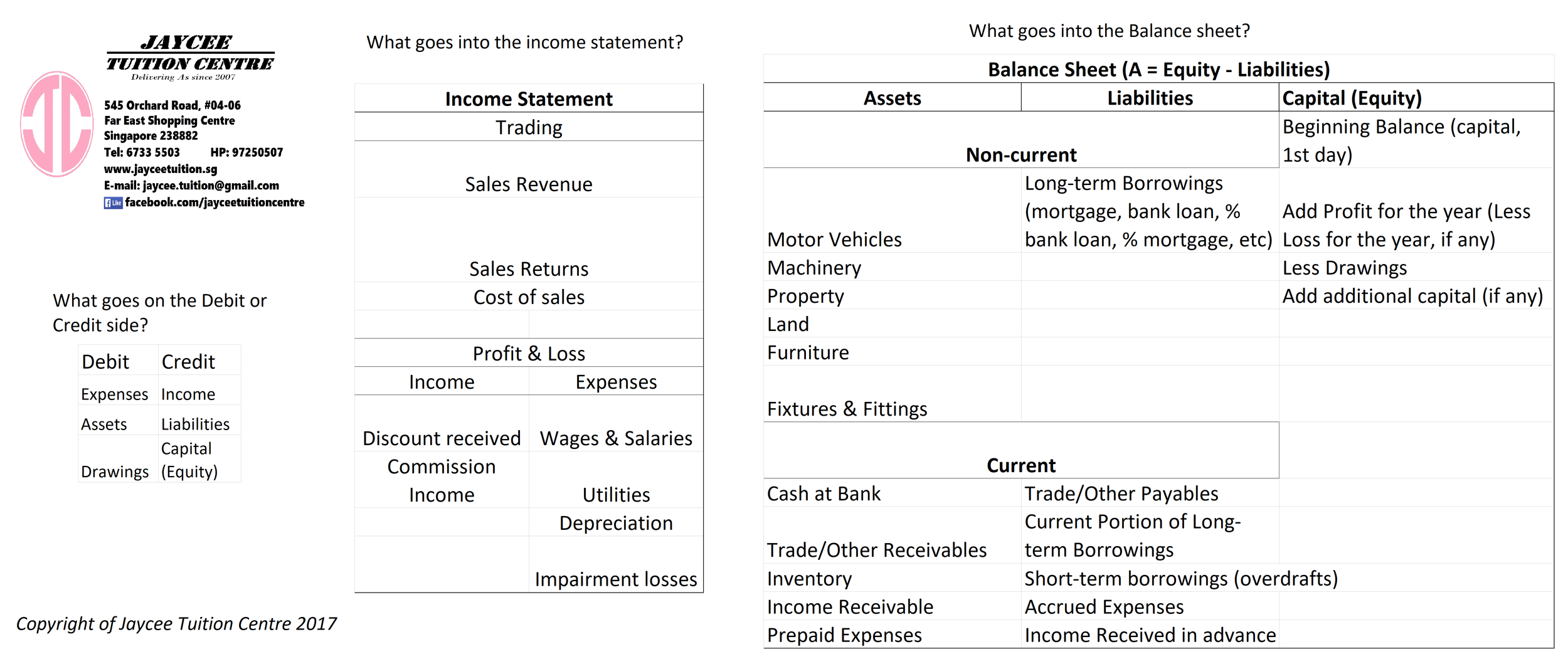

Debit? Credit? Where do they go? What goes into the income statement & Balance Sheet?

Debit: Assets, Expenses, Drawings

Credit: Liabilities, Income, Capital

What goes into the Income Statement?

Income:

Trading portion: Sales revenue, (Sales returns)

Profit & Loss: Any other income such as Commission income, Interest income, Rent income, etc

Expenses:

Trading portion: Cost of Sales

Profit & Loss: Any other expenses such as Stationary, Depreciation, Impairment losses, etc

What goes into the Balance Sheet? (Recall the accounting equation)

Assets = Owner’s Equity - Liabilities

Assets are split into: Non-current Assets & Current Assets

Non-current Assets Include:

Motor Vehicle

Property

Fixtures & Fittings

Furniture

Equipment

Office Equipment

Land

Machinery

Current Assets Include:

Cash at Bank

Cash in Hand

Prepaid expenses

Receivables (Trade receivable, Income receivable, Other receivables)

Inventory

Liabilities are split into: Non-current Liabilities & Current Liabilities

Non-current Liabilities include:

Long term borrowings (Bank loan, Mortgage loan, Loan)

Current Liabilities include:

Payables (Trade payable & Other payables)

Accrued expenses

Income received in advance

Current portion of Long-term borrowings

Owner’s Equity includes:

Beginning balance (capital)

Add Profit (from income statement)

Less Drawings

Add Additional Capital

What is inventory?

It is a resource that a business buys (from a supplier) for resale (to a customer)

Trade & Cash Discounts. What are they?

Trade Discount

A deduction off the list price

Given to encourage bulk purchases

Cash Discount

A deduction off an amount owing

Given to encourage prompt payment

Double (journal)entries on purchasing inventory and purchases returns:

Purchasing inventory:

Dr Inventory

Cr Cash in Hand/Cash at Bank/Trade Payable

Returning inventory to a supplier:

Dr Cash in Hand/Cash at Bank/ Trade Payable

Cr Inventory

Double (Journal)entries on sale of goods and sales returns:

Selling goods:

Dr Cost of sales

Cr Inventory

Dr Cash in Hand/Cash at Bank/Trade Receivable

Cr Sales Revenue

Sales Returns:

Dr Inventory

Cr Cost of sales

Dr Sales Returns

Cr Cash in Hand/ Cash at Bank/ Trade Receivable

The concept of First-in-first-out (fifo method)

The First-in-first-out (FIFO) method is used by a business with regards to how to manages its inventory.

This simply means that inventory that is first bought, will be sold first

For example,

On 1 January 2020, a business buys 100 units of goods for $100

On 8 January 2020, the business buys another 100 units of goods at $150

On 9 January 2020, the business sold 100 units of goods for $250

How much did it cost the business when it sold its goods on 9 January 2020? (How much is the cost of sales?)

Since the first 100 units bought cost the business $100, the cost of sales is therefore $100

$250 is the selling price and $100 was the cost since it was bought first on 1 January 2020

cost VS Net realisable value (NRV)

Cost

Represents the amount the inventory was purchased for

This amount does not change

Net Realisable value (NRV)

Represents the amount the inventory is worth (valued at)

This amount can change due to customer demand, outdated goods or damaged goods. It can bring the value of an inventory (goods) higher or lower)

Impairment Loss on Inventory

An impairment loss happens when the NRV of inventory is lower than its Cost. (NRV < Cost)

The double (journal) entry is:

Dr Impairment loss on inventory (expense)

Cr Inventory

What is depreciation?

It is the allocated cost of a Non-current Asset over its estimated useful life

Causes for depreciation:

Obsolescence (out-dated), Physical Deterioration, Passage of time, Usage, Legal limitations

Main concept involved: Prudence

Other concepts: Matching principle, Consistency Concept

Methods of Depreciation:

Straight-line Method

Depreciation is the same every year: Rate (%) x Cost

Cost – scrap (residual) value/Estimated useful life

Reducing-balance Method

Depreciation reduces every year

Rate (%) x Net Book Value

Net Book Value = Cost – Accumulated Depreciation

TRADE RECEIVABLES

What are Trade Receivables?

Entities owing the business due to a credit sale of goods

How are Trade receivables recorded?

Trade receivables less any allowance for impairment of trade receivables.

(They are recorded in the Balance Sheet under current assets)

TRIAL BALANCE

What is a Trial Balance?

It is a list of ledger balances on the last day of a business's financial period, where total debit entries must equal to total credit entries.

What is it for?

- To check for arithmetic accuracy

Tip: Know the nature for each transaction well!

Errors revealed by the Trial Balance:

- Omitted one entry

- Journal entry posted twice

Errors NOT revealed by Trial Balance:

- Compensating Error

- Error of Original Entry

- Error of complete reversal

- Error of Omission

- Error of Commission

- Error of Principle

Follow us on our Facebook to get more notes & tips